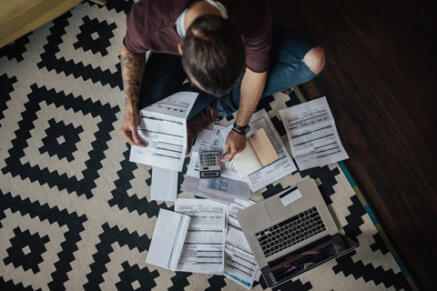

A year of pandemic: Impact on your finances

Adapting to the new normal

Working from home, lost jobs, reduced income, home schooling, lockdowns, severely limited social interactions, a fear of catching the virus… All of us have had to draw on our superpowers of adaptability to cope with these new realities. And it’s taken a long time. This situation can lead to feelings of anxiety for many people.

At the start of the pandemic, nearly 30% of Quebecers said their job status had changed and between 16% and 19% of households had requested payment deferrals.

CERB has been a life saver

Without the Canada Emergency Response Benefit, which enabled about 2 million Quebec workers in the restaurant, retail, hotel and cultural sectors to cover their immediate financial needs, the situation would’ve been even more extreme than it is today.

12 months in, what’s our status?

After that unexpected assistance, should we be worried that people will sink under the weight of their heavy debt in the months ahead?

No one had predicted the health crisis would last so long. Even though the vast majority of people have managed to stay on track, our hope is that conditions will get back to normal sooner rather than later. With that in mind, you can ensure you are ready for any eventuality by doing a financial health checkup to help assess your finances and by building a financial cushion.

Take action to make sure you’ll continue to be okay

The pandemic has impacted our finances as well as our mental health. There are some easy and effective ways to get your finances back in shape and maintain your mental balance.

- Stay informed by following reliable news sources and listening to the advice and recommendations from government authorities.

- Develop a routine. For example:

- Get up and go to bed at the same times every day and eat at regular intervals.

- Pay attention to your personal hygiene.

- Exercise regularly.

- Take breaks during the workday.

- Do activities that you enjoy.

- Stay in touch with friends and family by phone or online.

- Keep your spending in check. If you’ve successfully and sustainably reduced your expenses throughout the pandemic – by cutting back on restaurants and outings for example – you’ve already saved several hundreds of dollars every month.

Despite all the efforts you’ve made to keep your head above water, if you feel you may be losing the grip on your financial situation, remember that our counsellors in financial recovery and Licensed Insolvency Trustees are here to help you.

The pandemic remains an exceptional event that has required exceptional solutions and efforts in order to confront it. There’s no reason to be hesitant about wanting to have peace of mind.

Meet with one of our counsellors for free

Don’t ignore a debt problem that’s ruining your life. Let’s work together to help you regain control of your finances.