5 factors that impact your credit score

Summary

5 factors that impact your credit score

- Did the bank turn down your loan application or offer you sky-high rates? Your bad credit score could be the culprit! If you want to fix it, you’ll need to know what holds sway over your score.

- There are five main factors that impact your credit score: 1) payment history, 2) credit utilization, 3) length of credit history, 4) new credit applications, and 5) the amount and variety of lenders.

- If your score is low and keeping you from achieving your goals (new car, house, renos, trips, etc.), there’s good news: you can shore it up if you take action. Credit can be rebuilt!

What is a credit score?

Your credit score (or credit rating) is a metric of your financial health. It’s a bit like a portrait of your financial behaviour and payment history.

It gives lenders an idea of your creditworthiness based on whether you’ve paid past bills in full, by the due date. It essentially shows whether you can pay your debts on time.

Scores vary between 300 and 900, with 900 being a perfect score.

In Québec, there are two companies that collect your data to calculate your credit score: Equifaxand TransUnion. They use your financial history, repaid debt, credit cards and other factors to draw up your score.

Your financial portrait: it’s all about image

Financial institutions take five key factors into account before granting loans, lines of credit or credit cards:

- Debt ratio

- Credit score

- Monthly income

- Assets

- Employment stability and residence

What goes into a credit score?

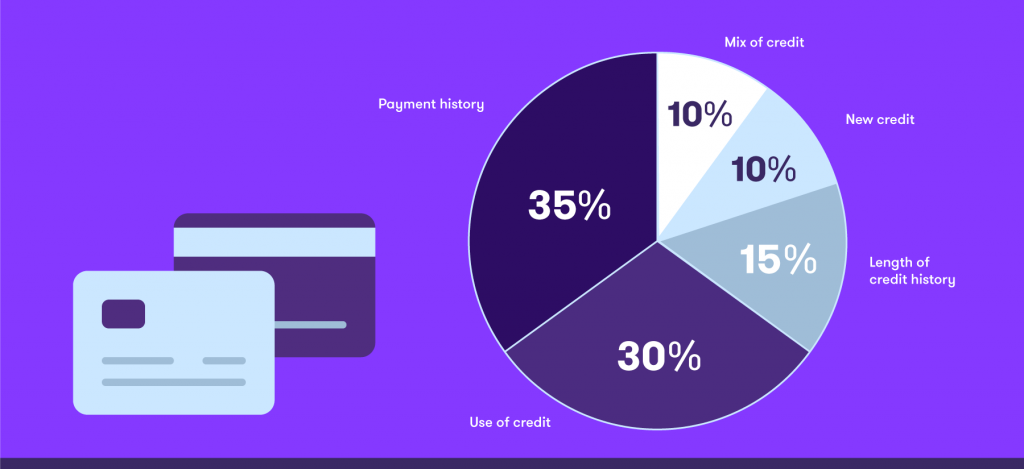

There are five main factors that determine your credit score.

Your payment history

This makes up 35% of your score.

Of course, it’s important to pay your bills, credit cards and line of credit on time and in full. This will boost your creditworthiness.

It’s important to remember that any late payment past 30 days will stay on your record for several years, regardless of the amount. And the later the payment, the greater the impact it will have on your score.

Your credit utilization

This makes up 30% of your score.

If you’re using more than 50% of your credit card or line of credit, it could affect your rating. This is true even if you pay the full amount every month.

Tip:

- Try to have a credit limit that’s twice what you plan on charging to your card. For example, if you plan on putting $250 on your card each month, you should have a card with a $500 limit.

Length of credit history

This makes up 15% of your score.

The longer your account has been open, the more long-term repayment habits your lenders can see. And the length of time you’ve had a good credit history has a proportionally positive impact on your score too.

Tips:

- If you don’t need to change banks or service providers, keep your accounts open for as long as possible. Avoid getting new cards for no reason.

- Just keep one card: the oldest.

New credit applications

This makes up 10% of your score.

Every time you apply for credit, it’s reflected on your score. The way financial institutions see it, you’ve submitted a lot of applications because you’re looking to take out a lot of money and you’re at risk of going into debt. This can have a negative impact on your score.

Tip:

- Submit several applications at once to multiple institutions. If you submit them all within two weeks, it will only count as one credit check.

The amount and variety of lenders

This makes up 10% of your score.

Credit scores are higher if you have different types of credit, not multiple accounts of the same type of loan.

Tip:

- It’s good to have different accounts (personal loan, car loan, line of credit, mortgage, etc.), but not several of the same kind (like several credit cards). This suggests that you’re at high risk of going into debt.

But be careful—having multiple loans increases your risk of not making payments on time.

How can I find out my score?

You’re entitled to a free credit report. You just have to fill out the form at Equifax or Transunion to receive your copy in the mail.

Some banks also offer this service free of charge on their websites. Ask your financial institution if this is the case.

How does this affect me?

If you’re applying for a loan like a credit card or line of credit, lenders can check your score to get an idea of your financial habits. (However, your information cannot be consulted without your consent.)

If you don’t have a good rating, your application could be refused or accepted at a high interest rate. The bank might also require collateral or a guarantor.

Either way, if you don’t have good credit, you can rebuild it. It’s not a lost cause!